I am a huge fan of European tech and am very excited about the Wise (formerly known as Transferwise) direct listing in the UK. I am writing this post as a way to better understand the company myself and hope it is of some use to other people. It represents my personal views and is for education purposes only. You should check out Kristo Käärmann (Wise CEO) twitter - he is doing an absolutely fantastic job of demystifying the listing process and providing insights into the business.

The deep dive is primarily based on Wise’s regulatory filing (“registration document”). Furthermore, it is supplemented with some external research and market data. I highly recommend that you read the actual registration document to gain a comprehensive understanding of the business. I should note that a lot of blood and sweat from junior bankers and lawyers went into drafting the document. :)

Executive Summary

“Founded in 2011, Wise is a global cross-border payments network which aims to replace traditional international banking for personal and business customers. Wise is used to send money across borders, get paid like a local in 30 different countries and spend money in 176 countries around the world.”

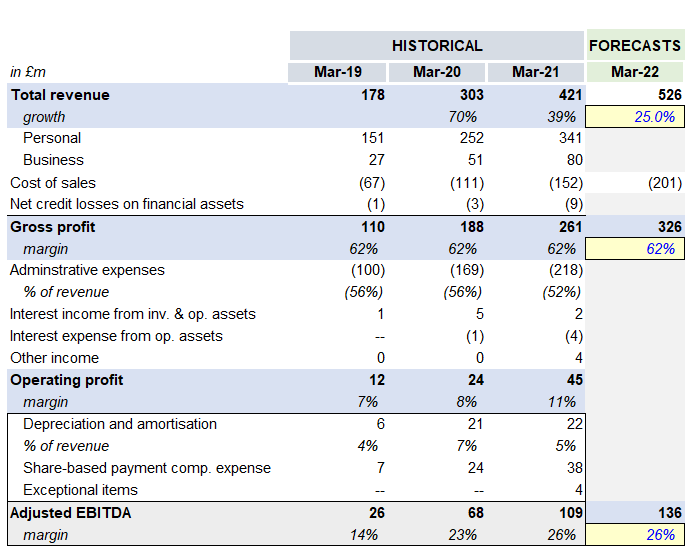

Wise processed £54bn of volume in FY2021, saving customers over £1bn in fees during the year. This volume translated into £421m in revenues (+39% YoY growth) and resulted in a 26% adjusted EBITDA margin. It has over 5.7m personal users and c.300k business users. It currently employs c. 2,400 people across the world and is actively recruiting for 220 roles. Kristo and Taavet (co-founders) still own 30% of the company. Other notable institutional investors include Valar Ventures, IA Ventures, a16z and Baillie Gifford.

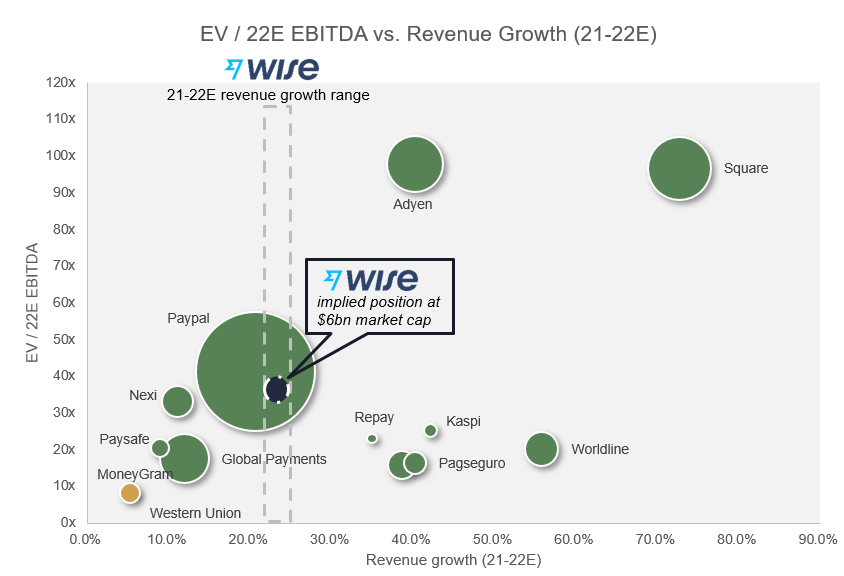

Wise is planning to go public in London via a direct listing on 7-Jul-21. It will not raise any primary proceeds. Kristo (CEO) gave the following rationale for a direct listing vs. a traditional IPO: “We chose a direct listing because everyone has the same opportunity to own a part of Wise, from large institutions to customers. It’s less expensive than an IPO which helps us keep costs down and ultimately helps us on our mission to lower prices.” Wise is rumoured to achieve a valuation of $6-7bn (likely conservative estimate), implying 33-38x EV / 22E EBITDA multiple. It should be noted that Wise will be the first direct listing in the UK market. Hence, we are in somewhat uncharted territory, and I hope it makes up for an excellent case study for IPO alternatives in the European equity markets.

In summary, there is a lot to like about Wise as a business. It is a founder-led business with a clear mission and addresses massive pain points for consumers and businesses. With 20%+ topline durable growth and underlying profitability (20+% EBITDA margin), it also has an attractive financial profile. Over the last decade, Wise has established itself as a major money transfer service in Europe. Future growth will come from continued geographic expansion (US, APAC are big markets) as well as continued expansion into cross-border payments for SMBs.

Product Overview

A) What problem does Wise address?

“Moving money internationally is broken. Traditional banks are reliant on an outdated network of correspondent parties and held back by complex infrastructure.” Therefore, money transfer services from traditional banks are expensive, slow, inconvenient and opaque. Having built a replacement payments infrastructure (more details in infrastructure section) over the last decade, Wise is able to offer a significantly better proposition on multiple dimensions, as shown below.

B) Current Product Portfolio

According to the registration document, Wise’s key products include:

“Wise Transfer: With Wise transfer, customers can send money to more than 80 countries, covering over 85% of the world’s bank accounts. “Wise transfers are (a) on average up to 8x cheaper than leading UK high street banks and (b) over 38% of transfers delivered instantly and about 83% in less than a day. “

Wise Account: Targeting frequent travellers, Wise multi-currency account (comes with a debit card) allows users to hold and exchange 56 currencies at real exchange rate with up to 10 sets of international bank details (e.g. EUR IBAN, USD routing number and account number etc.) for one account. So far, Wise has issued over 1.6m Wise debit cards.

Wise Business: Targeting freelancers, entrepreneurs and SMBs, Wise business account provides international banking features to its 300k+ business customers. Wise Business “also provides business-specific functionalities including invoicing, payment automation and accounting integration, multi-user accounts, enhanced spend money benefits through the Wise Business debit card, batch payments, recurring (scheduled) payments and API-based payment workflow automation.”

Wise Platform: “Wise Platform allows banks and enterprise partners to integrate Wise’s payments network into their own mobile applications or online banking. To date, Wise has completed Wise Platform integrations with 15 banks in 11 countries with customers including banks (Monzo, N26, Stanford Federal Credit Union), enterprise partners (Xero, Google Pay) and distribution partners (Temenos, Thoughtmachine).” As of 31-Mar-21, the annualised volume run-rate of Wise platform was over £1bn. The Wise platform has broadly similar economics as compared to direct customers.

C) Long term Product Roadmap / Vision

Wise is a very mission-driven organisation with a clear purpose of “powering money without borders for everyone, everywhere”. It “aims to achieve it by growing cross-border volumes and continuing to build its global payments infrastructure. It is one of the few companies I know that also publish its product roadmap (available here).

As Marc Rubinstein points out in his excellent post, Wise is not regulated as a bank, which means it faces less stringent regulatory capital requirements. However, it also inherently restricts its product portfolio as it cannot offer credit products.

Payments Infrastructure

Over the last decade, Wise has replaced the correspondent banking system with its own infrastructure that stitches together local payment systems and so eliminates intermediaries and manual processes, leading to reduced fees and faster transfers. Wise’s underlying infrastructure is the source of its commercial success and core to its business model. Wise enters new geographies by partnering with local financial institutions to access domestic payment rails. Once it has an established presence, it seeks its own licenses and effectively disintermediates the local institutions. More details can be found on p. 46-49 of the registration document.

Market Opportunity

A) TAM

£18 trillion of payments volume was moved across borders in 2020, with people and businesses charged £190 billion for this service. Money is moved internationally for the following main reasons:

(a) Personal (C2C / C2B): use cases include personal remittances, eCommerce transactions, real estate investments and other bills, like tuition and healthcare payments. According to Credit Suisse estimates, 35% of all remittance transactions are cash-based, which means they cannot be handled by Wise.

(b) Business / SMB (B2C and B2B): use cases include wages and salaries, freelancing and contracting payments, and account payables by businesses.

Furthermore, Personal and micro/SMB customers make up 50% of the overall market volume, but they make up the majority (c.95%) of the fees paid. Hence, Wise is focusing on where the money is. The dynamics seem to be similar to other payments markets such as merchant acquiring, where SMBs account for 17% of volumes but 55% of revenue in the US market.

B) Market share and current customer base

Within the personal segment of the cross-border payments market, Wise has a c.2.5% market share based on volume. Furthermore, Wise has c.5.7m active personal customers and c.305k active business customers.

Competitive Landscape

The competitive landscape for Wise is multi-layered as it addresses multiple use cases that can be broadly categorised as:

Personal / Remittance: Key competitors for the remittance use case include traditional high street banks, money transfer (Western Union, Ria, MoneyGram, Intermex, WorldRemit, Remitly) and neo-banks (Revolut).

Business/ Enterprise: Traditional banks dominate this particular segment. However, according to Credit Suisse “marketplace sellers and freelancers are increasingly engaged on a cross-border basis, creating a need for cross-border currency management platforms such as Payoneer, EBANX, Airwallex, PingPong, and others, along with similar offerings neo-banks such as Revolut.”

Furthermore, blockchain technology has the potential to disrupt Wise’s ‘money transfer across borders’ use case. As an example, Ripple has the mission to “move money to all corners of the world.” Ripple may not be the right answer, but it hints at the wider potential of blockchain technology for the money transfer use case.

GTM Strategy

In FY21, c.67% of new customers joined Wise through referrals, with the remaining 33% acquired through paid marketing.

The high referral rate, coupled with an NPS score of 76%, implies inherent product virality. Wise’s current referral terms imply a CAC of <£17 through this channel.

In relation to paid marketing, Wise is known for some amazing PR stunts that helped drive awareness in the early days. In 2014, Wise organised a flag mob of employees in just their underwear at various London landmarks to show how the company had “nothing to hide” (Source). Today, paid marketing is more focused on traditional advertising with aiming to acquire customers while maintaining a payback period of less than 12 months in each of its paid marketing channels. Based on several assumptions (0.4m new personal users acquired through paid marketing / £22m paid marketing expenses), Wise achieved a blended CAC of ~£18 through paid marketing channels in FY21.

Financials — Deep Dive

A. Key Financials

A) Revenue

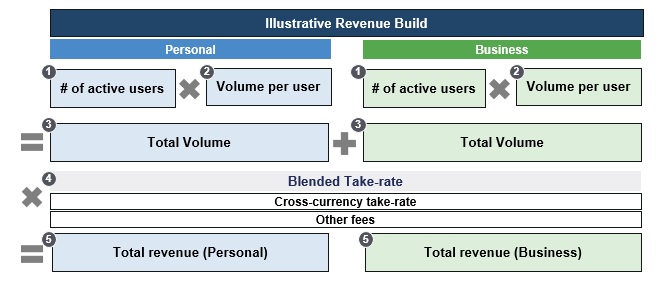

I have sketched out the revenue build of Wise below. Revenue is effectively (i) number of active users * (b) volume per user * (c) blended take-rate across personal and business customers. As per the table above, total revenue increased by 39% to £421m in FY21 with the revenue increase primarily driven by an increase in total volume. Wise expects FY22 “revenue growth in the low to mid-twenties on a percentage basis.” Furthermore, Wise expects revenue “to grow in the medium term at a CAGR of over 20%.” It should be noted that guidance at IPO is typically conservative to allow management to beat and raise guidance.

A comprehensive analysis of the revenue drivers is provided in the appendix. While personal users generated c.81% of revenues in FY21, business users share is growing faster albeit from a smaller base. Furthermore, 55% of the revenues were generated in Europe (including the UK). Business user expansion and geographic expansion are two important drivers of Wise topline going forward.

B. Operating Cost Base Over Time and Mid-term Margin Framework

The chart above shows (a) the opex breakdown and corresponding EBITDA margin over the last 3 years as well as (b) the mid-term margin framework (as outlined in the registration document).

B1) Gross Profit Margin: Gross margin reflects (i) the cost of sales as well as (ii) net credit losses on financial assets. In FY21, the gross profit margin marginally decreased to 62%.

Disentangling the underlying cost items - in FY21, the cost of sales increased by 36% to £158m with the increase primarily a result of the increased volume and corresponding revenue growth. The cost of sales itself can be disaggregated into (a) bank and partner fees and (b) net foreign exchange and other product costs. Wise is exposure to “FX movements from holding assets and liabilities in different currencies and guaranteeing customers an FX rate for a limited period of time.” “The risk of incurring an FX related loss is most acute during periods of short-term fluctuations in FX rates such as COVID-19 related volatility in Mar-21.

Furthermore, net credit losses on financial assets increased to £9m due to a specific provision related to money laundering allegations in Brazil (selected press coverage here).

B2) EBITDA margin

The improvement in EBITDA margin, from 23% to 26% in FY21, demonstrates decent operating leverage. It is primarily driven by administrative expenses (decreasing from 56% of revenue in FY20 to 52% of revenue in FY21. In the medium term, “Wise expects EBITDA margin to remain above 20%.”

Valuation Perspectives

A) Illustrative Analysis at Various Prices

The table above shows the market cap, enterprise value, and the corresponding valuation multiples for various market caps. According to rumours, Wise plans to direct list at c.$6-7bn valuation, (highlighted via the green box), implying a 33x-38x EV / 22E EBITDA multiple. In the next section, I will put the range in the context of where other companies are trading.

B) Putting Valuation Into Context - Valuation vs. Growth

Unfortunately, there are no direct comparables for Wise in the public markets. The scatter plot above comprises (a) legacy remittance players such as MoneyGram and Western Union and (b) selected merchant acquiring / financial processing players.

Some conclusions that can be drawn - Firstly, there is a positive correlation between revenue growth and EV / EBITDA multiple. Secondly, legacy remittance players are trading at low multiples as they display low revenue growth. Thirdly, there is a distinction between (a) fast-growing fintech platforms such as Adyen and Square that command a very rich multiple and (b) other merchant acquiring / financial processing players.

Assuming Wise achieves a $6bn market cap at the direct listing, it would be trading at 33x EV/22E EBITDA based on 25% revenue growth and 26% EBITDA margin.

Current Ownership and Direct Listing Considerations

Wise has a dual-class share structure, which provides enhanced voting control to certain shareholders (predominantly Kristo and Taavet) that hold the majority of Class B shares. However, no existing shareholders will have more than half of the voting rights purely by virtue of holding Class B shares.

In summary, Kristo and Taavet (co-founders) together still own an impressive 30% stake in the business (based on Class A share ownership). Peter Thiel’s Valar Ventures and IA Ventures (both fintech investors) own 10%, respectively. Other major investors include a16z, Baillie Gifford, D1 Capital Partners and IVP.

Following the direct listing, “the Class A shares will be freely and publicly transferable and it is expected that in excess of 25% of the Class A shares will be held in public hands.” Regarding the precise mechanics of price discovery on the day of admission, certain existing shareholders have entered into a liquidity provision with the participating banks (GS and MS) to sell an aggregate amount of c.2.44% of the Class A shares in the opening auction of the direct listing on 7-Jul-21. Separately, certain existing shareholders have agreed to lock up an aggregate amount of c.22.5% of the Class A Shares for 180 days from the day of admission.

Appendix

A) Revenue Build Components

Disclaimer

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Thank you for doing this. Exactly the sort of analysis I'd been looking for!