SoftBank's $2bn+ Investment in The Hut Group ("THG")

An interesting bet on e-commerce and e-commerce enablement

I am a huge fan of European tech and want to increase awareness of interesting listed European tech companies. SoftBank recently announced c.$2bn+ in total equity investment in The Hut Group (“THG”), a UK-listed e-commerce platform. I found the transaction quite interesting (partly due to its complexity) and wanted to share some initial thoughts on the company as well as the transaction structure.

Company Overview

As per IPO prospectus: “Founded in 2004, THG is a vertically integrated digital-first consumer brands group, powered by THG Ingenuity, its proprietary end-to-end e-commerce technology and operating platform.” Listed in the UK, THG IPO’d in Sep-20 and has a market cap of £6.0bn / $8.5bn.

“THG's business is operated through the following four business lines:

THG BEAUTY: A leading digital-first brand owner, retailer and manufacturer in the prestige beauty market, combining THG's prestige portfolio of seven owned brands across skincare, haircare and cosmetics ("THG Beauty Own Brands"), with the provision of a global route to market for over 850 third-party beauty brands through its portfolio of websites, including Lookfantastic, Skinstore and Mankind ("THG Beauty Retail") and the beauty subscription box brand Glossybox;

THG NUTRITION: A manufacturer and online D2C retailer of nutrition products and owner of the Myprotein brand, including its family brands Myvegan, Myvitamins, MP Clothing and Myprotein Pro;

THG INGENUITY: THG Ingenuity provides an end-to-end direct-to-consumer e-commerce solution for consumer brand owners under SaaS licences, in addition to stand-alone digital services, including hosting, studio content and translation; and

OTHER: This business consists of the THG Lifestyle (consumer and luxury products) and THG Experience (Hale Country Club in Cheshire, United Kingdom, and King Street Townhouse Hotel and the Great John Street Hotel, both in Manchester, United Kingdom) businesses”

Alexandre Dewez did a pretty good write-up on the business last year (available here).

SoftBank’s Investment in The Hut Group (“THG) and its Ingenuity Division

Softbank Northstar

The investment was done by SoftBank’s Northstar team, which was set up to invest in public equities.

According to FT, “SB Northstar is managed by former Deutsche Bank trader Akshay Naheta, who masterminded SoftBank’s investment into Germany’s Wirecard two years ago. The entity is best known for its role in pumping up share prices in a number of technology companies last year, in an incident that led to SoftBank being dubbed the “Nasdaq whale”. Moulding [THG’s CEO] said he had negotiated directly with Naheta and his team “but anyone who knows SoftBank will know that Masa has the final say”.”

Background and Transaction Structure

The transaction structure of the deal is quite interesting and makes sense once you dig into the transaction background, which is as follows:

As THG’s CEO disclosed on the Analyst call, SoftBank was interested in investing in the THG Ingenuity division and wanted to deploy significant capital in that division immediately. However, THG was not ready to accept the capital directly into Ingenuity as it is not a separate corporate entity today. It would have been tricky to inject c.$2bn+ at Group level (I presume due to UK takeover rules + it just gets messy in terms of governance). Furthermore, the idea of using convertibles was floated but such large convertibles are quite rare in the UK equity market. Finally, THG suggested the current transaction structure that is outlined below to ensure that they have ample time to carve out the Ingenuity division into a separate entity but agree on terms today.

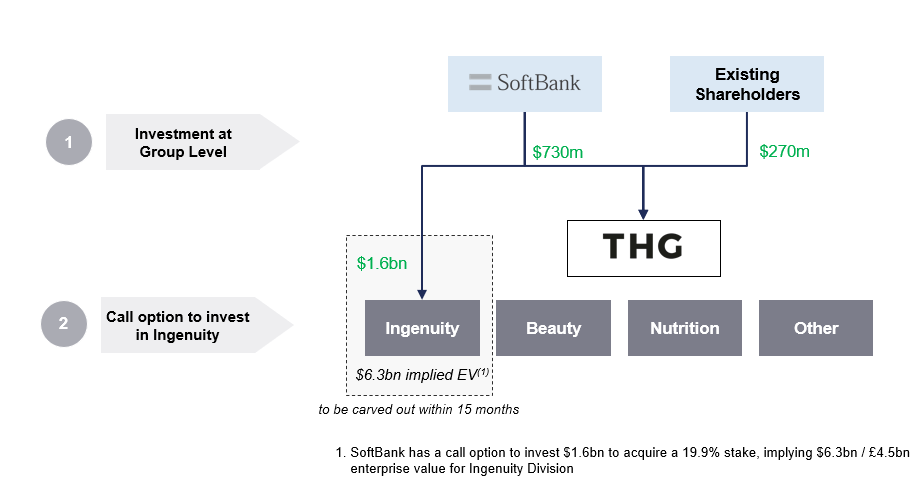

Investment at Group level: SoftBank led a $1bn investment at THG Group level, conducted through an accelerated book-build. More specifically, SoftBank injected $730m and existing investors injected $270m in equity.

Call Option to invest in Ingenuity: Additionally, “THG has granted SoftBank a call option, exercisable by way of a $1.6bn primary shares subscription for THG Ingenuity equity, giving rise to a 19.9% interest in THG Ingenuity (the "Option"). The Option attributes to THG Ingenuity an enterprise value of $6.3 billion (£4.5 billion). For the purposes of the Option, it is anticipated that THG Ingenuity shall be separated from THG into a THG owned and controlled subsidiary company (the “Separation”). THG has agreed to effect the Separation within 15 calendar months (the "Separation Period") from the date of this announcement, although retains the right to extend the Separation Period by up to a further 6 calendar months where reasonably required. THG retains the discretion to separate THG Ingenuity by way of an IPO, sale process, or other structural options.”

Furthermore, THG and SoftBank have agreed to explore future commercial arrangements between both parties that are not disclosed at this stage.

What is the “Ingenuity Platform”?

THG describes the Ingenuity platform as a “proven enablement platform for frictionless, end-to-end digital commerce, with its ability and value demonstrated by the Group’s digital leadership positions in the Beauty and Nutrition categories.”

According to FT, "What exactly the Ingenuity business does is something of a riddle: chief executive Matthew Moulding described it as a “social media influencer platform” but it also handles the prosaic business of logistics and translations for third parties launching in new markets.”

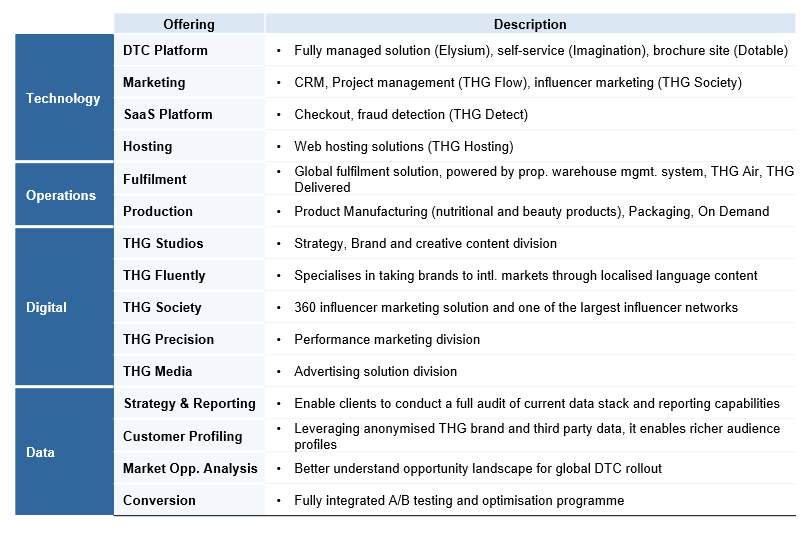

Having dug through the nice but confusing Ingenuity website, I have summarized the key product offerings of the Ingenuity division below.

In summary, the Ingenuity platform is an end-to-end platform that includes infrastructure (e.g. fulfilment) as well as software solutions that are needed to launch a DTC brand at scale.

The Ingenuity platform has multiple use cases but at its core, it competes with several large e-commerce platforms such as SAP, Shopify, Oracle, and Adobe. Its client base includes large companies such as Hotel Chocolat, L’Occitaine (Elemis), P&G (Gilette). However, the largest clients are internal THG brands that use the Ingenuity platform.

Valuation Considerations

Softbank’s investment implies an enterprise value of £4.5bn / $6.3bn for THG Ingenuity division. On the Analyst call, THG CEO mentioned that sales multiples approach (as of today and as of FY 2023) was used to support the valuation. In Q1-21, THG Ingenuity generated c.£40m in revenues, implying a ~28x Q1-21 revenue run-rate multiple. It should be noted that the division is not carved out and therefore the financials (historicals shown below) might look different once carve-out is completed.

The factors below also played a dominant role in determining the valuation.

SoftBank wanted to invest a large amount: SoftBank’s minimum cheque for such an investment is likely around $800-$1bn

THG’s only wanted to sell a minority (<20%) stake: THG’s CEO was also clear that he did not want to sell more than a 20% stake in the division. He mentioned on the Analyst call that “it would be a very different valuation if it was a greater than 19.9% stake.”

To put things into perspective - the Group IPO’d in Sep-20 at a market cap of £4.5bn and now one of their divisions has been assigned an enterprise value of £4.5bn. Pretty wild outcome for an e-commerce business in the current volatile market!

What will THG do with $2.6bn in incremental cash?

THG now has $1bn at the Group level to invest and $1.6bn in cash that is ring-fenced at the Ingenuity division level, assuming the call option is exercised.

Group level

THG has historically grown through M&A and in fact announced the $255m acquisition of Bentley (New Jersey-based prestige beauty developer and manufacturer) last week. Given their M&A track-record, I expect THG to use the capital to acquire more brands in the coming years.

Ingenuity Division

Post SoftBank investment, one could argue that the Ingenuity Division is overcapitalized in its current state. According to management, c.$100m of capex is spent per year in this division. Therefore, it will take a while to get through $1.6bn. The Group may decide to increase capex but it is unclear why they had not done it in the past as they had significant access to capital. They raised c.£1bn in net proceeds at IPO last year. Conducting acquisitions to bolster the tech platform is another way to invest incremental cash. THG CEO already hinted that they want to expand the security aspect as well as develop a payment gateway technology so look out for acquisitions in those segments.

How does SoftBank win?

The most likely outcome would be a potential spin-off of Ingenuity Division and subsequent IPO, enabling SoftBank to capture value. In the meantime, SoftBank has indirect and “liquid” exposure to e-commerce through its $730m equity investment in THG at the Group level.

Sources

Company Materials

Disclaimer

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.