I am a huge fan of European tech and want to increase awareness of interesting listed tech businesses by writing company deep dives. As part of the research process, I have started tracking some European names and analysing their quarterly earnings. I found Allegro’s latest earnings quite interesting and wanted to share some initial thoughts on the business ahead of a deep dive. Please feel to reach out if you would like to provide any feedback / discuss the company in detail.

Company Overview

Business Description

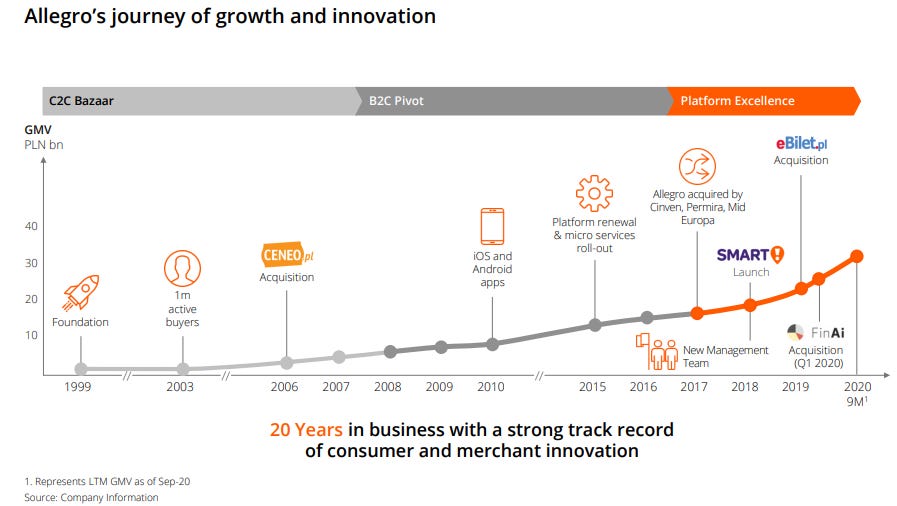

Founded in 1999 in Poland, “Allegro is the leading online managed marketplace in Poland that links buyers with products offered by merchants. Merchants sell across a variety of categories including automotive; home and garden; books, media, collectables and art; fashion and shoes’ electronics; kids; health and beauty; sports and leisure; and supermarket.” As the majority of the transactions on the platform are third-party (“3P”), Allegro is similar to Alibaba’s e-commerce marketplace model. Furthermore, Allegro has deployed several tactics from the Amazon / Alibaba / Mercado Libre playbook to drive growth, including Prime subscription (SMART!) and adjacent revenue streams, including advertising and fintech products.

“Allegro is one of the most recognized e-commerce brands in Poland. In fact, over 20 million internet users visit the site every month, which is equivalent to 63% of the Polish adult population (16y+). With 13.2m active buyers and $7.6bn in GMV (FY2020), Allegro represents 3% of the total retail market in Poland.”

In Oct-20, Allegro IPO’ed on the Warsaw Stock Exchange (biggest-ever IPO in Poland). After a strong share price performance, the share price has recently declined, which is in line with the performance of other e-commerce businesses as the economy reopens. As of today, Allegro has a market cap of $16bn.

Business Model - Deep Dive

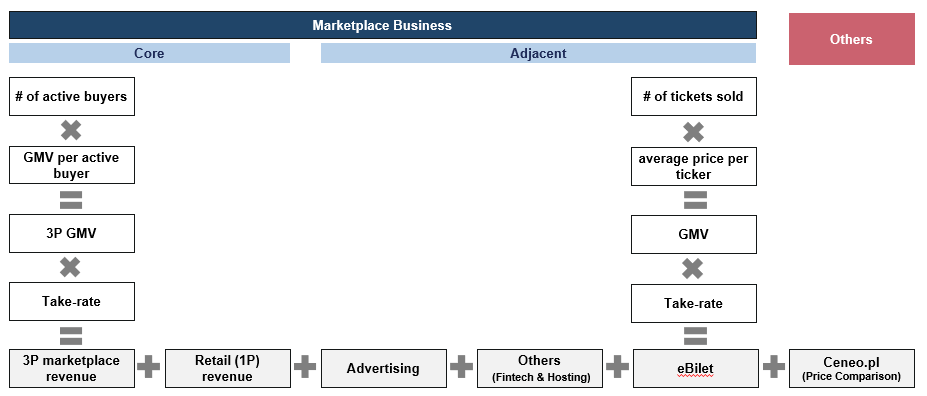

Since 1999, the Group has transitioned from a C2C marketplace to a B2C marketplace and ultimately to an ‘e-commerce platform’. In order to better understand the current business, I have sketched out the key revenue segments below. 3P Marketplace revenue accounted for 81% of 2020 revenue and is the main pillar of the business. Other adjacencies include Retail (1P) revenue, advertising, others (fintech & hosting), eBilet (event ticketing) and price comparison (Ceneo.pl).

Marketplace Business

3P Marketplace Revenue

“Marketplace generated revenue primarily through facilitating 3P transactions between buyers and merchants and charging merchants commissions and other related fees.” Key drivers of 3P Marketplace revenue are (a) number of active users, (b) GMV per active user and (c) take-rate.

Retail (1P) Revenue

The Group also has its own limited-scale, 1P retail business that is intended to supplement the 3P business, representing 0.6% of Group’s GMV in FY2020. From what I understand, it is not regarded as a growth driver but rather as a mechanism to provide liquidity in categories (as needed) and to kick-start new categories.

Advertising

“The Group earns advertising revenue by providing various types of advertising opportunities to brands and merchants on the platform”. On a regulatory front, a digital advertising tax in Poland has been proposed and may represent some downside risk, if voted into law.

Others (Fintech)

While the majority of “other revenue” comprises hosting services today, I would like to focus on the fintech products, captured in “other revenue” as they are regarded as key growth drivers for the business going forward.

Allegro Pay for Users

“The Group recently launched Allegro Pay, in order to provide new revenue streams from lending fees and interest. Allegro Pay features targeted credit availability; market standard credit checks at loan originations; seamless user experiences; and a simple and intuitive checkout process. Allegro Pay is easy to set up and quick to use and offers buyers a pre-approved purchasing limit up to PLN 4,000 / $1,100 with the ability to buy now and pay either in 30 days with no interest or instead in up to 20 monthly instalments.”

Factoring for Merchants

“In the second half of 2020, the Group entered into a cooperation agreement with invoice factoring provider PragmaGo to offer instant payment services for merchants. The factoring service allows merchants to receive payment immediately after selling a product on the Group's platform, while the Group is able to provide buyers with a deferred payment option.”

eBilet - Event Ticket Platform (acquired in 2019/20)

“Leading event ticket sales site in Poland, facilitating sales of a broad range of entertainment, cultural, family and sports events, with c.2.3m tickets sold in FY2019. The business was obviously disrupted by the shutdown of live events last year. As ticket sales follow the marketplace model, the eBilet revenue is part of the marketplace revenue segment and not broken out separately.

Others

Ceneo.pl - Price Comparison Website (acquired in 2006)

“Ceneo.pl is the leading multi-category price comparison site in Poland. In 2019, it attracted an average of 21 million monthly users. As of June 30, 2020, 18,000 online retail stores were registered on Ceneo.pl and information on 23 million product offers was available to consumers using the price comparison service.”

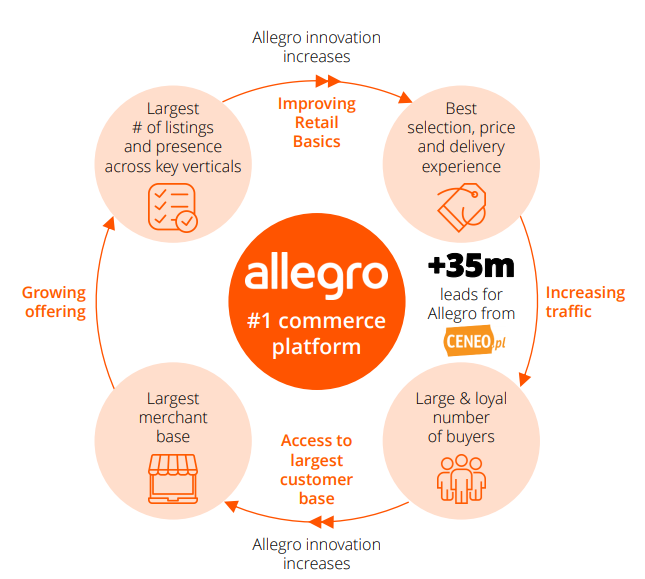

Network Effects

Similar to other marketplaces, Allegro benefits from strong network effects, a source of defensibility. The ‘flywheel’ can be described as follows: “As more merchants join the platform, the breadth of the products offered increases and price competitiveness improves, which in turn leads to increases in the number of buyers browsing and purchasing on the Group’s e-commerce marketplace. Conversely, as more buyers browse for and buy products, merchants become increasingly attracted to the Group’s e-commerce marketplace”

As a result of Allegro’s dominant market position, supported by network effects, buyers love the platform due to its superior (a) selection, (b) price and (c) convenience compared to other platforms.

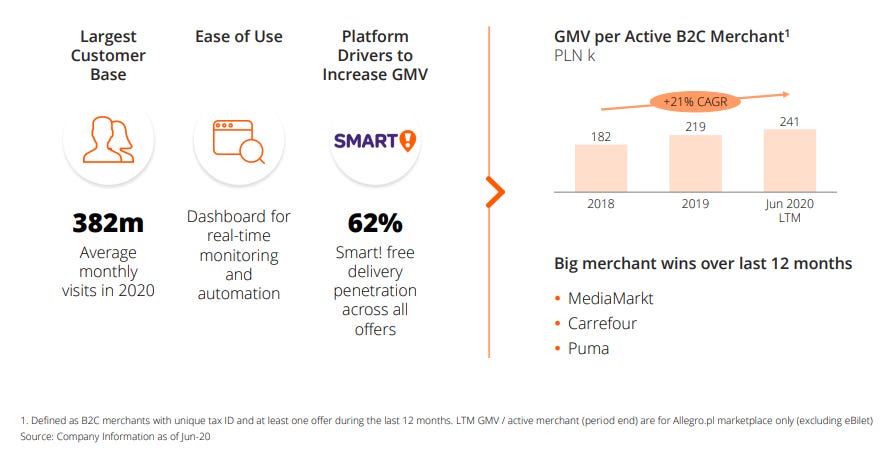

On the supply side, Allegro is the main choice for merchants due to (a) its large customer base, (b) ease of use and (c) platform drivers to increase GMV.

Q1-21 Financial Performance

On 13th May 2021, the company announced their Q1-21 financial results. As an e-commerce business, Allegro clearly benefitted from the lockdowns last year, leading to tough comps for financial performance this year. Overall, the company announced a good set of results, including strong GMV growth, coupled and high profitability, against tough comps. Detailed financial analysis is provided below.

Key Financial Highlights

The table above shows the historical P&L in $m with key line items analysed below. I have not analysed the opex items to keep this section short and crisp.

1) GMV: Allegro generated $2.6bn in GMV (+46% YoY), attributed to the following factors:

Active buyers: The number of active buyers increased to 13.2m (+13% YoY )

GMV per active buyer: Increased spend per active buyer (+39% YoY) due to strong execution of retail basis (better selection, prices and convenience) and increased penetration of SMART! (Amazon Prime equivalent), driving higher engagement

2A) Marketplace revenue: Allegro generated $269m in revenues in Q1-21 (+63% YoY). An increase in take-rate led to marketplace revenue growth outstripping marketplace GMV growth.

Take-rate: Increased by c.110 bps, primarily due to (a) cumulative impact of monetisation initiatives such as SMART!, co-financing couriers and introduction of co-financed lockers in Jan-21. It should be noted that the basic commission take-rate is increasing rather gradually. Therefore, management expects take-rate to decrease slightly during the upcoming quarters.

Furthermore, in order to normalise the COVID-induced metrics in 2021, management guided towards 30% CAGR (19-21E) for marketplace revenues. Due to strong performance, Q1-21 marketplace revenue currently implies a 40% CAGR (19-21E), which is significantly ahead of the prior ‘30% CAGR (19-21E)’ guidance.

2B) Advertising Revenue: Allegro generated $27m in advertising revenue (+69% YoY), growing significantly faster than marketplace revenue albeit from a much smaller base. More and more merchants are using the service and the Group has invested in delivering better RoI by improving ad targeting through better AI/ML models. In the long run, management expects advertising revenue to reach 2% of the total GMV.

2C) Price Comparison Revenue: Ceneo.pl generated c. $14m in revenues in Q1-21 (+14% YoY), which is significantly below marketplace revenue growth. There are some benefits of owning a price comparison website as it generates leads for the core Allegro platform, but management does not seem to regard it as a key growth driver for the business.

3) EBITDA Margin: In Q1-21, Allegro achieved a 44% EBITDA margin, which is impressive compared to its peers. The margins have deteriorated compared to historical quarters as investments into rapid SMART! growth initiative remains a drag on profitability. Furthermore, management expects further investment into Smart!, organisation and delivery experience (“DEX”) projects, which are expected to reduce margins for the rest of the fiscal year.

4) Profit Margin: In Q1-21, the company achieved 22% profit margin (+51% YoY). Below EBITDA margins improvements, it was driven by a reduction in financial costs as the company delevers post IPO.

Key Takeaways

The company has achieved higher revenue growth than prior guidance. The management has done an excellent job in their IR efforts and explained the key drivers of the business exceptionally well. I wish more European companies would be that structured in their IR efforts. With regards to revenue segments, the core marketplace is growing nicely with advertising revenue and fintech revenue serving as key growth drivers (more details in next section). It should be noted that the company will experience tough comps in the next 1-2 quarters as the full extent of lockdowns were felt in Q2/Q3-20. Furthermore, it is unclear to what extent demand will shift towards offline channels as the economy opens up. However, the Group has a high margin of error due to its conservative topline guidance and strong margin profile.

Operational Performance - Key Highlights

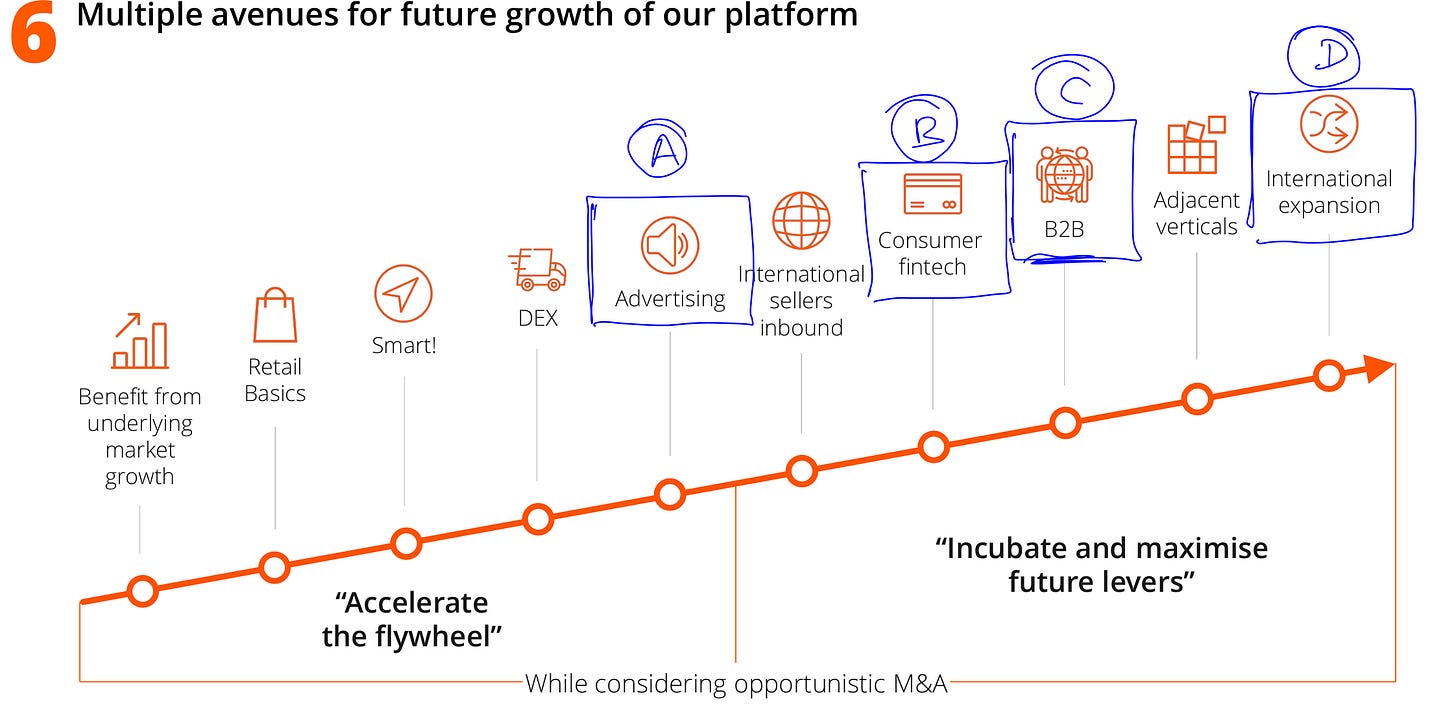

Management has clearly outlined how they plan to grow the business, as shown in the screenshot above. I have analysed selected growth levers, including (a) consumer fintech, (b) B2B marketplace and (c) international expansion below.

A) ADVERTISING

Advertising is seen as a natural and potent growth driver for the business. Other platforms have successfully leveraged advertising to increase effective take-rate. Allegro is still in the early innings with advertising to reach 2% of GMV in the medium term. As of Q1-21, number of advertisers grew x2 faster than total merchants with ads revenue gaining share to >1% of GMV.

B) CONSUMER FINTECH

“Allegro Pay is scaling up and gaining popularity with triple-digit QoQ growth (originated PLN 179m loans) in consumer loans. Outstanding consumer NPS of 87.5” The Group is on track to achieve its 2021 internal target. Management has not shared any metrics such as the number of users. NPLs are within the 2% limit and external financing partners will be announced by end of the year.

C) B2B MARKETPLACE (“Allegro Biznes”)

In Feb-21, Allegro launched its B2B platform (“Allegro Biznes”), which has been “well-received by users (particularly SMEs) and the number of sellers participating in the dedicated B2B programs is ramping up as planned.” The B2B platform includes several features such as net pricing, quantity-based discounts, bulk delivery and direct payments. While the management has not disclosed any metrics, the GMV growth is higher than core platform growth albeit from a significantly smaller base.

D) INTL. EXPANSION

International expansion (M&A or organic) is an interesting strategic lever for the business. In theory, Allegro could use its brand as a platform to expand across the CEE region and transform from a dominant Polish e-commerce platform to a CEE e-commerce platform. Given the increasingly competitive environment (In recent months, there have been some rumours that Allegro is interested in acquiring Czech Mall Group. While the management has not commented on the rumours, they do consider countries with low internet penetration in the region attractive.

Competition Heating Up in Polish E-commerce

“What happens if Amazon enters the market” is one of the largest concern for any regional e-commerce marketplace. Historically, Amazon used its German website/platform to serve Polish users and the consensus was that Poland is “too small” for Amazon to bother entering, particularly given Allegro’s competitive position. However, in Q1-21, Amazon announced plans to enter the Polish market and enabled sellers to register for its Polish website. Separately, “Alibaba announced plans to invest in parcel lockers in Poland to speed up delivery from Chinese merchants via its AliExpress platform” (Bloomberg). I think the bear case would be that Allegro gets ‘squeezed’ in Poland - Alibaba captures market share in lower-priced segment and Amazon captures the high-end segment.

On the Q1-21 earnings call, the management acknowledged the change in the competitive landscape but did not see any financial impact (yet) from increased competition. I think that the next couple of quarters will be critical in (a) gauging how serious Alibaba and Amazon are about the Polish market and (b) how defensible Allegro’s business model is in reality. I also want to understand how management reacts to increased competition. Any change in the competitive landscape will have implications for the steady-state market structure, as it will impact Allegro’s long term revenue growth and margin profile.

Illustrative Valuation Considerations

Based on the latest share price (PLN 57), Allegro trades on a c.10x EV / 22E Revenue and on c.25x EV / 22E EBITDA multiple. The company is expected to grow revenues at 26% (21-22E) with 40% 22E EBITDA margin.

Sources

Company Materials

Google Finance

Disclaimer

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.