A Closer Look at Listed UK Tech on the LSE AIM Market

On the pursuit of finding diamonds in the rough

Quick Overview of the UK Aim Market

Launched in 1995, AIM (“Alternative Investment Market”) is the London Stock Exchange’s market for publicly listed small and medium size growth companies. According to LSE, the AIM market has achieved several impressive milestones:

In 1995, AIM launched with 10 companies valued at £82m. Today, AIM is home to around 850 companies with a combined market cap of £104bn.

Since 1995, over 3,865 companies have raised over £115bn on AIM.

The average amount of money raised during the first five years of AIM was £2.8m. During the past five years it has been £21.4m.

In its first full year of trading, the daily volume of trades of AIM companies averaged 21.9m. In the current year, it’s 2.4bn.

AIM-listed companies “represent many business sectors, ranging from mining, entertainment, retail and support services to software and biotechnology.” (HBCG) Particularly for high growth tech companies, an IPO on the AIM market can be a viable alternative to traditional VC / growth equity funding.

On first look - in terms of performance, the FTSE AIM All-Share index seem to have effectively traded sideways if you exclude the 2000 tech bubble. However, it should be noted that AIM-listed companies as they “grow / mature” often migrate from the AIM to the Main Market and are therefore excluded from the index. Over the last 10 years, c.35 UK companies have migrated and include several success stories such as Paysafe, GVC Holdings and BCA Marketplace.

In today’s post, I conduct a deep dive into the tech segment of the LSE AIM market and look at (a) size distribution, (b) sub-sector breakdown and (c) overview of the largest tech companies on AIM.

As of Jan-21, there are 88 tech companies listed on the AIM market with a combined market cap of c.£15bn. Full list available on request.

A. Size Distribution

The histogram above shows that sample size skews heavily towards micro-caps with 70% of the tech companies below £100m market cap and 53% below £50m market cap. Furthermore, there are only 3 tech companies (GB Group, Blue Prism and Learning Technologies) with a >£1bn market cap and 9 with a >£500m market cap.

From an institutional investor’s perspective, companies with <£100m market cap , would be too “illiquid”, which significantly reduces the potential universe of investable tech companies. It also means that retail investors tend to dominate the AIM market, especially in the micro cap (<£100m market cap) segment.

B. Sub-sector distribution of tech companies above £50m market cap

The subsample of 40 tech companies (>£50m market cap) shows that several sub-sectors are represented on the AIM. Firstly, software represent c.44% and typically includes on-premise / “legacy” software with a few exceptions. There are also an interestingly large number of vertical software companies (e.g. EMIS Group. Craneware, Tribal Group). Secondly, IT Services represent c.15% and typically include BPO / tech consulting companies. Thirdly, gaming represents c.12% with constituents including Codemasters (recently received an acquisition offer from EA) and Sumo Group. Finally, healthtech and payments represent small sub-segments with ‘others’ (includes Data Analytics, Ticketing, Telematics etc.) accounting for 19%.

Overall, the tech segment is relatively diversified but “frontier / new tech” is underrepresented or just simply missing.

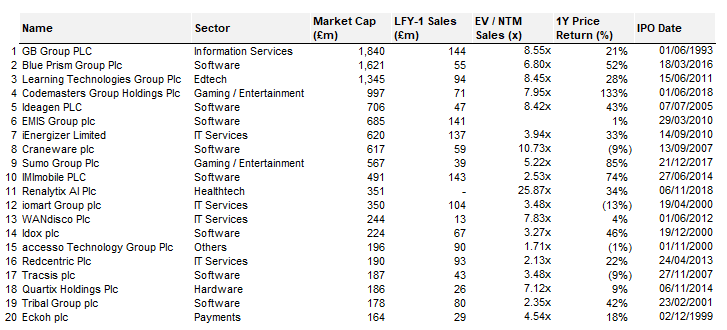

C. Top 20 - Largest Tech Companies

The table above shows the top 20 tech companies by market cap. GB Group, a UK-based identity management business, is the largest constituent with a market cap of c.£1.8bn. Couple of observations on the top 20 list:

Wide range of tech sub-segments are represented

Valuation multiples for software companies are significantly lower than US software albeit unadjusted for growth

Average LTM share price performance of the list above is 31%, significantly lower than NASDAQ

Several companies on the top 20 list have IPOed in the last 5 years and have been quite successful, highlighting the potential of the AIM market:

Blue Prism (RPA software provider): +1,500% since IPO in 2016

Renalytix AI (AI-enabled in vitro diagnostics): + 380% since IPO in 2018

Sumo Group (gaming): +190% since IPO in 2017

Codemasters (gaming): +146% since IPO in 2018

Final remarks

The AIM market is an interesting hunting ground for retail as well as institutional tech investors. While larger and more established tech companies tend to IPO on the Main Market (e.g. The Hut Group) or prefer a US listing, AIM attracts interesting companies that are traditionally overlooked. These companies can generate excellent returns if they manage to “break out” of the AIM market. However, investors need to conduct in-depth research and require patience to find the diamonds in the rough.

Chirag,

Thank you for this. It's intereting and informative.

Have you updated it recently?

Chirag, thanks so much for posting. I was wondering if you could share your list of 88 names would be curious to take a look!